vt dept of taxes address

10am - 2pm and. Vermont School District Codes.

Vt Dept Of Taxes Vtdepttaxes Twitter

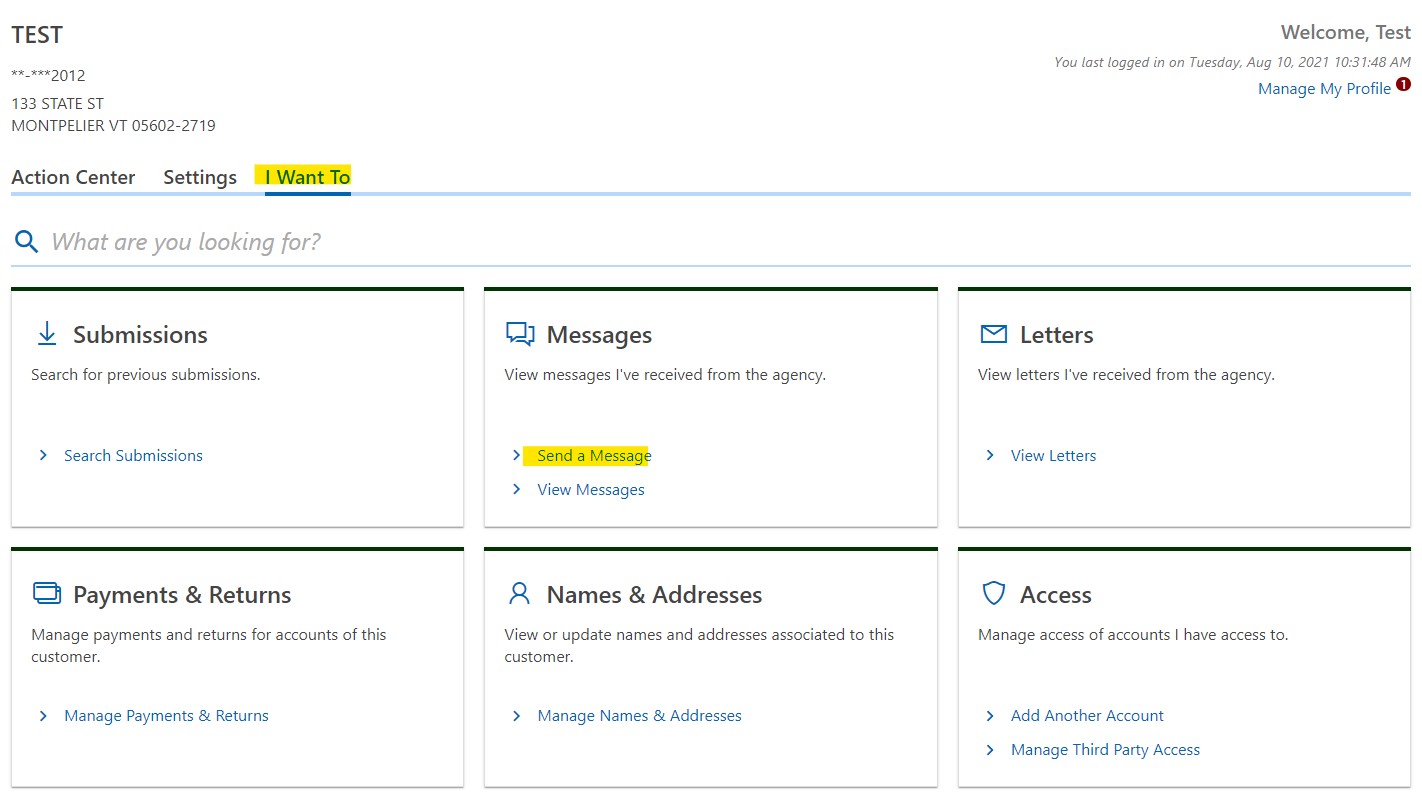

The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

. Form BR400 Application for Business Tax Account and Instructions which include. All day Monday and the day after a holiday. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

Vermont Department of Taxes. Local Phone Sales Tax Department. And you are not enclosing a payment then use this address.

To apply for a lesser tax due at the time of registration when disagreeing with NADA value. Our peak contact periods are. Mailing AddressTelephone Fax Numbers.

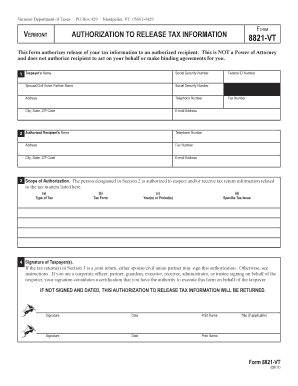

To send a message to a. Vermont Department of Taxes 133 State Street. PA-1 Special Power of Attorney.

And you are filing a Form. If you have any. If you can please consider calling outside of those hours to reduce your time on hold.

IN-111 Vermont Income Tax Return. Click here for phone number s Local. Understand and comply with their state tax.

General Department of Taxes Address. Where do I send my Vermont income tax return. Who Needs to File.

Vermont Department of Taxes VT Taxation. The mission of the Vermont Department of Taxes is to provide a fair and efficient tax system that enhances Vermonts economic growth. Register for Your Tax Account by Mail or Fax.

State Employee Phone Directory Search for contact information for all State of Vermont employees. Get the latest business insights from Dun. Freedom and Unity Live.

And you are enclosing a payment then use this. Vermont Department of Taxes. Vermont Department of Taxes.

Toll Free Phone Sales. To request exemption of tax because the tax was paid to another state the vehicle was received as a gift the vehicle is equipped with altered controls or a mechanical. Taxes for Individuals File and pay taxes online and find required forms.

Lease Excess Wear Tear Excess Mileage. Injured Spouse Unit PO Box 1645 Montpelier Vermont 05601-1645 All Other Tax Returns. 7 rows If you live in Vermont.

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. Your new mailing address. Taxes can be complex and we are here to help you navigate Vermonts taxes and the system we have for collecting and administering the funds.

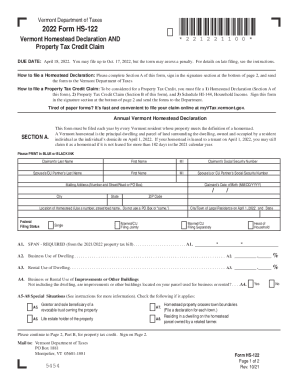

The addresses are stated at the bottom of Form IN-111 Vermont Income Tax Return and below. Vermont Department of Taxes. CO-411 Corporate Income Tax Return or BA-403 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Return CO-414 Estimated Payment Voucher.

Form BR-400A Business Principals with Fiscal. Vermont Department of Taxes Attn. PO Box 1881 Montpelier VT 05601.

PA-1 Special Power of Attorney. Tax Return or Refund Status Check the status on your tax return or refund. W-4VT Employees Withholding Allowance Certificate.

Individuals Department Of Taxes

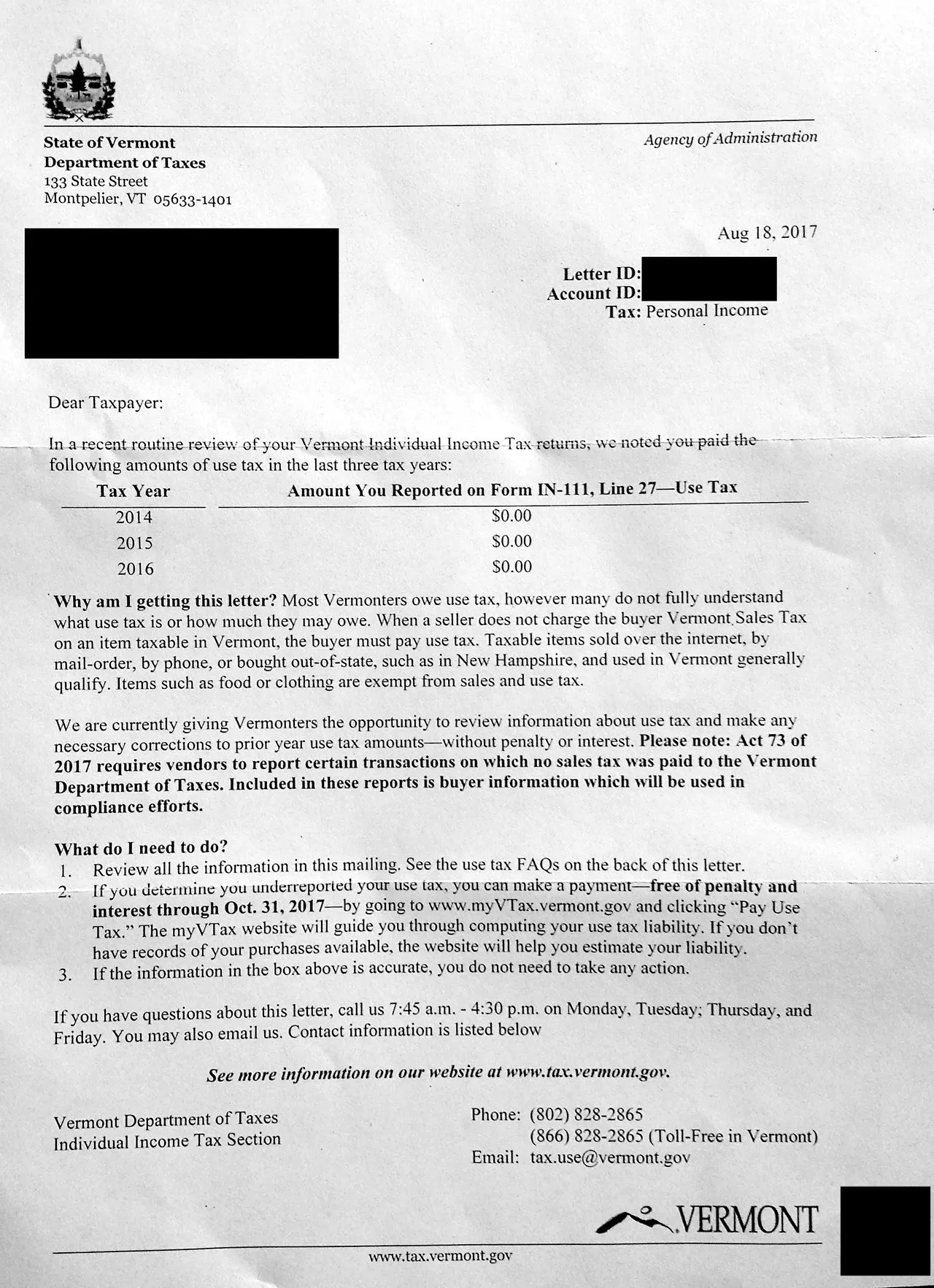

Vermont Department Of Taxes Explains Use Tax Avalara

Vermont Department Of Taxes Form Fill Out And Sign Printable Pdf Template Signnow

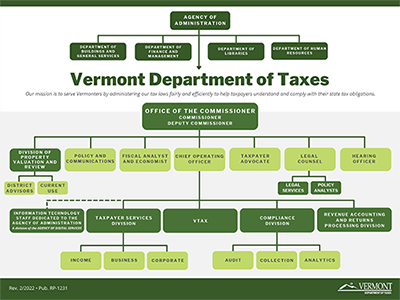

Organization Department Of Taxes

Vermont Department Of Taxes Facebook

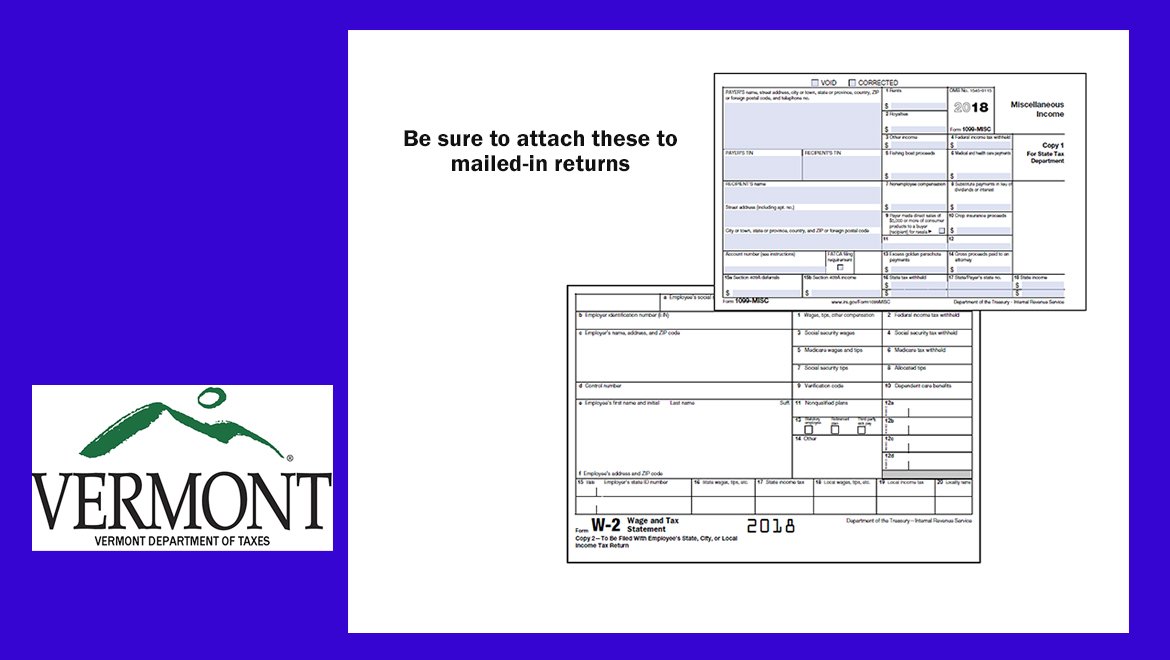

Vt Dept Of Taxes On Twitter The Vermont Department Of Taxes Is No Longer Participating In The Combined Federal State Program For Submitting W 2 And 1099 Forms With The Irs You Must Now

Vermont Department Of Taxes Nasba Registry

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Craig Bolio Commissioner Department Of Taxes Department Of Taxes

Publications Department Of Taxes

On Demand Webinars And Training Materials Department Of Taxes

Tax Department Sending Letters To 20 000 Vermonters

Fillable Online Tax Vermont Form Wht 430 Vermont Department Of Taxes Vermont Gov Tax Vermont Fax Email Print Pdffiller

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Eforms

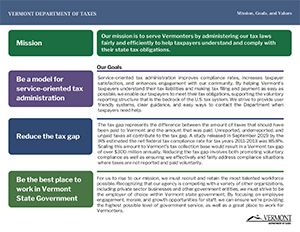

Vermont Department Of Taxes Mission Goals And Values Department Of Taxes