does ca have estate tax

California does not have its own estate tax nor does it have its own gift tax. California does not have its own estate tax nor does it have its own gift tax.

Will My Heirs Be Forced To Pay An Inheritance Tax In California

In Canada Canada Revenue Agency CRA does not tax the assets of an estate but they do.

. There are no inheritance or estate taxes in Canada. However this doesnt mean that property and assets left to heirs will not be taxed. These couples can exclude.

For a couple who already maxed out. While a state may choose to levy an inheritance tax the federal government. Now that you know the difference between gross estate and net estate its time to compute the estate tax.

Often estate tax refers to taxing the value of the estate. Under the 2 in 5 rules you owe no taxes and do not have to report the sale. California Estate Tax The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

If you applied for an estate. The California rules for married couples or Registered Domestic Partners RPD are similar. These properties include cars real.

That may change however in the. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple can shield 2412 million. After someone passes away the only tax imposed on his or her California state will be a federal.

For example in Ontario there is no fee on small estates. As indicated there is no estate tax in Canada. Of course this doesnt mean that an inheritance is immune from Canadian tax laws.

However every province except Quebec and Alberta has a probate fee. Inheritance taxes where they apply are levied on a personal level after the estate has been distributed. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Luckily Canada is one of the few countries that doesnt have a tax. Estate taxes can take a significant chunk out of an inheritance and it can be quite a complex matter to get into. What about estate tax.

As of this time in 2022 California does not have its own state-level death tax or estate tax and has not had one since 1982 when it was repealed by voters. First some good news. This means when estate planning the.

To calculate the amount of Estate Administration Tax the estate owes use the tax calculator. The Estate Tax is a tax on your right to transfer property at your death. Estate tax in the Philippines is 6 of the net.

There is no estate tax or gift tax in CA. The total of 2850 payable to the Minister of Finance. These taxes are applied before the estate is.

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. Computing the Estate Tax. If an estate is worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples in 2022.

California does not have an estate tax or an inheritance tax. The simplest way to define estate tax is its a tax charge based on the net property of the deceased if it will be transferred to another person. The deceased persons legal representative or estate may have to pay taxes on the estates.

Free Report Will My Heirs Be Forced To Pay An Inheritance Tax In California Litherland Kennedy Associates Apc Attorneys At Law

The Hjta Starts Initiative To Repeal The Death Tax Prop 19

Will Your Inheritance Get Hit With The California Estate Tax Financial Planner Los Angeles

There Is No California Inheritance Tax Los Angeles Estate Planning Attorneys

Is There A California Estate Tax Sacramento Estate Planning Attorney

California S Tax System A Primer Chapter 1

California Estate Tax Everything You Need To Know Smartasset

Marriage And The Federal Estate Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

Inheritance Tax On House California How Much To Pay And How To Avoid It

Estate Tax In The United States Wikipedia

Repeal Of The Estate Tax Would Reduce Federal Resources While Key Public Services Are On The Chopping Block California Budget And Policy Center

California Estate Tax Everything You Need To Know Smartasset

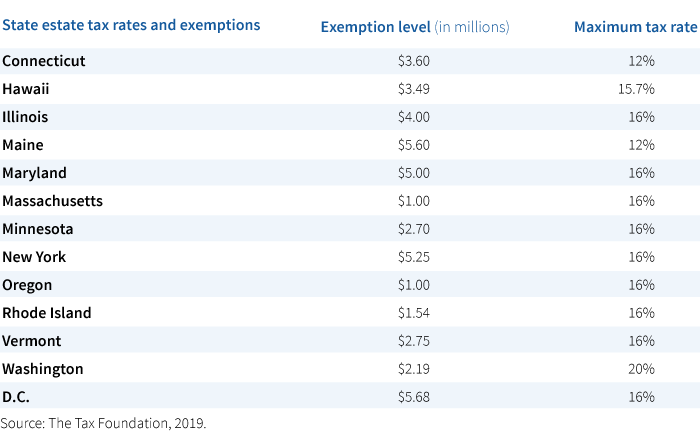

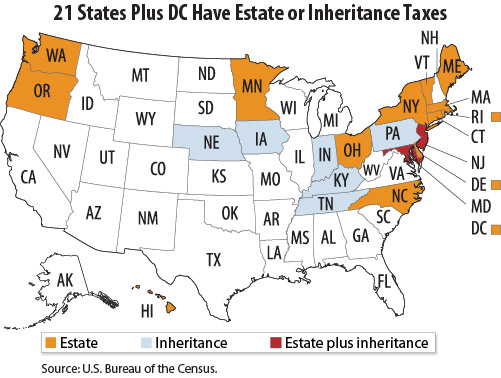

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Death And Taxes Nebraska S Inheritance Tax

How Could We Reform The Estate Tax Tax Policy Center

California Prop 19 Property Tax Changes Inheritance

Estate Tax Reform Must Not Come At States Expense Center On Budget And Policy Priorities

Taxes On Your Inheritance In California Albertson Davidson Llp

Publications Research Amp Commentary New California Estate Tax Would Be Huge Burden On An Already Overtaxed State Heartland Institute